How to Implement Pending Costs

Goal

The goal of this document is to better understand how to take advantage of Pending Costs in Collection-Master. Vertican implemented this feature in Collection-Master version 8.4.

What are Pending Costs?

Pending costs are a special category of cost disbursements. They are particularly useful when you don’t want to increase the consumer balance when the costs are disbursed but do expect to charge the consumer for these costs at a future date.

Examples:

- Costs expended before judgment will become recoverable after judgment is granted.

- Garnishment costs will become recoverable after the garnishment succeeds.

In either of these examples, the debtor balance will not increase until the costs become recoverable.

The Paradox

Three balances must be reconciled; these balances contradict each other and do not match. Costs must be both non-recoverable and recoverable at the same time. Each entity has its own opinion on what the balance should be.

| Entity | Costs Definition | Balance Definition |

|---|---|---|

| Forwarder

(Your Client) |

• Costs are costs. • All costs to be recovered. |

• Balance includes all costs. |

| Firm

(You) |

• Costs broken down into buckets.

– Recoverable expended – Non-recoverable expended – Pending costs expended |

• Balance includes recoverable expended.

– Sometimes a firm will recover non-recoverable or pending costs. In these cases, the balance will show a credit for the recovery. |

| Court |

• Only costs that have been awarded.

– Other costs are not considered by the court. – Some jurisdictions allow recovery of costs before they are awarded. – Non-recoverable costs are never awarded. |

• Balance includes costs awarded. |

- Most of the discrepancies are due to timing.

- The client thinks that all of the collections are applied to costs.

- The court thinks that none of the collections are applied to costs.

What was the process before Pending Costs (i.e. the original process)?

- Spend costs and bill the consumer.

- Recover and return costs.

- Costs are awarded at judgment but are billed upon spending.

This solution works well enough but incorrectly shows that the costs are recoverable and conflicts with the court rules.

The Problem with the Original Process

- Spend costs as non-recoverable expended.

- Recover non-recoverable costs by using the optional “N” collection order.

- Very confusing.

- Conflicts with legitimate non-recoverable costs.

- Move each non-recoverable cost to recoverable costs at judgment.

- This is a click-to-buy feature in Collection-Master.

- [2-1-2-X] creates itemized transactions.

- Costs are transformed into recoverable costs.

- Balance increases.

- Enter judgment.

The original process works but relies on people remembering to do the right thing. It’s also very confusing: how can you recover “non-recoverable” costs?

The New Costs Paradigm

- Spend costs as pending costs expended.

- Recover pending costs using the optional “J” collection order.

- This separate bucket does not conflict with other types of costs recovered.

- Move pending costs to either recoverable or non-recoverable costs [2-1-2-W].

- Case-by-case and itemized.

- Single button to [Select All] makes the typical case much easier to post.

- Balance increases as appropriate.

- Enter judgment.

The new solution provides an itemized trail of activity, showing the original expenditures as “non-recoverable” and then details the amount that was transferred from pending costs to either non-recoverable or recoverable costs.

Buckets

In Collection-Master accounting, payments are assigned to a bucket with codes between 1100 and 9100. Pending costs are applied to the 1120 category.

| Category | Description |

|---|---|

| 1100

• 1111 • 1112 • 1120 • 1121 |

Principal

• Merchandise – Prin • DP No Fee – Prin • Pending Costs Recovered • Non-Recvr Costs Recovered |

| 1201

• 1202 |

Collect & Hold

• Remit from Coll & Hold |

| 2100

• 2111 • 2112 |

Interest

• Merchandise – Int • DP No Fee – Int |

| 3100 | Contract Interest |

| 4100

• 4111 – 4190 |

Costs Recovered

• Costs Recovered – DP – Other Costs Recovered |

| 5100 | Firm Costs/Charges |

| 6100

• 6120 |

Statutory Attorney Fees

• Legal Fees |

| 9100 | Other |

Cost Subtypes

Cost disbursement codes are 33-80 and 501-599. In addition to the cost code, the following subtypes indicate that costs are moving to a new category.

| Category | Description |

|---|---|

| .001 | Move Costs to Recoverable |

| .002 | Move Costs to Non-Recoverable |

| .003 | Pending Costs Disbursed |

| .004 | Pending Costs to Recoverable |

| .005 | Pending Costs to Non-Recoverable |

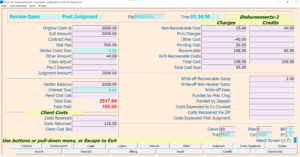

Disbursement Account Card

The disbursement account card shows how costs have been allocated: charges and credits, as well as the amounts applied to the various buckets.

Financial Trail

You can see various samples below. For example, TA #124327 was originally expended as (P) or Pending Cost. The next transaction, TA #017041, shows that the (P) or Pending Cost was removed, and TA #17040 shows the (P2R) or Pending Cost to Recoverable. TA #17040 applied the previously pending costs to recoverable.

Notice that the process involves three separate transactions.

The Impact of Pending Costs on Interest

Pending costs are not part of the consumer balance, so interest will not accrue on pending costs. When you move pending costs to recoverable, interest will accrue as defined in [1-S-4-W] Multi-State Interest Setup.

Master.Cost_EXP / Master.Cost_Recovered – FILEREC(16) / FILEREC(17)

Pending costs recovered should increase Master.Cost_EXP / Master.Cost_Recovered, when a payment is applied to Pending Costs Recovered.

- The fields must contain BOTH regular costs and pending costs recovered so that all reports that report “COSTS” will show both combined.

- There are separate fields that track the various types of costs.

| Field | Description |

|---|---|

| MASTER.PEND_COLL | Pending Costs Recovered |

| MASTER.NR_COST_COLL | Non-recoverable Costs Recovered |

| MASTER.REC_COSTS_COLL | Recoverable Costs Recovered |

| MASTER.FIRM_COSTS_COLL | Firm Costs Recovered |

| MASTER.OTHER_COST_COLL | Other Costs Recovered |

| MASTER.WO_COST_PAID | Write-off Costs Paid by Debtor |

Direct Payments [2-1-2-2]

While posting a direct payment does allow you to recover and return “normal costs,” pending costs are different, and you will not be able to apply these to a direct payment.

To recover pending costs, you must move pending to recoverable before posting the direct payment. That will increase the debtor’s balance accordingly.

Costs Returned to Us [2-1-2-3]

When posting Costs Returned to US, you are prompted with “Credit debtor or pending (Y/N/P)”. Select P to apply to Pending Costs.

Once you have selected “P” you will be asked to apply the costs returned to a specific transaction:

If you cannot find an appropriate match, you will be asked to manually select the transaction.

Pending Costs Returned to Us show up on the account card as accounting code 3.003.

AutoCost: Move Non-Recoverable to Pending Cost in Batch

Use the Move Non-Recoverable to Pending Cost in Batch [2-1-8-6] feature to convert transactions previously posted as non-recoverable.

This program will convert the original transaction from non-recoverable to pending. The Paperless File will be updated to reflect this change.

A new Financial Code 90.0908 Stamp will indicate that claims had an adjustment from non-recoverable to pending costs.

- This will mark the changes to update the Account Card fields.

- Non-recoverable costs recovered in the Account Card must be 0.00, or the claim will reject.

- Claims where [2-1-2-X] was used are ineligible. If an [2-1-2-X] action were done on a claim, the claim will reject.

- Claims must be pre-judgment only, or they will be rejected.

AutoCost – Convert Non-Recoverable to Pending

Move Firm Costs to Pending in Batch [2-1-8-7] will work similarly to Move Non-Recoverable to Pending Cost in Batch [2-1-8-6]. Use [2-1-8-7] to post the “AutoTrans” transactions. The purpose of this routine is to convert a previous “Firm Cost Expended” transaction into a “Pending” transaction. Later, the pending cost can be moved to non-recoverable or recoverable (as if the cost was originally non-recoverable). This is available for AutoCost only and will not have an applicable 2-1-2 menu path.

- Required Headings

- FILENO

- TRANS_TYPE

- REFNO

- PENDING

Special Tags for Collections

It can take the court a very long time to award judgment. Between the time you requested the judgment and the time it was awarded, it is likely that payments were received. Technically, you are supposed to amend the judgment, but no one does that.

Add a new tag *PstJPay to the claim when you request the judgment, and future payments will be posted as (J) or post-judgment payments.

Trying to reconcile the balance with the court becomes very difficult if your judgment does not reflect the new payments and you try to post them as (P) or post-suit payments.

| Tag Code | Tag Description |

| +PstSPay | When posting a collection, change the (B)efore to (P)ost Suit. |

| +PstJPay | When posting a collection, change the (P)ost Suit to (J)udgment. |

How to Set Up Pending Costs in Collection-Master [2-S-2]

Pending costs are set up in [2-S-2]. See “Setting Up Cost Disbursements” Mastermind video.

How to Spend Pending Costs in Collection-Master [2-1-3]

Spending pending costs is performed the same as any other cost disbursement. Navigate to [2-1-3] and pick the cost that has been set up as pending, and Collection-Master will do the rest.

How to Move Pending Costs to Non-Recoverable or Recoverable [2-1-2-W]

Moving pending costs to either non-recoverable or recoverable is performed by navigating to [2-1-2-W].

If you are not in a cost account, you will be prompted to select the correct Cost Account.

- You will be prompted to allocate each pending cost to either “Non-Recov” or “Recov.”

- Use [F2] to select all entries or pick the desired items, and then [F3] or [F4] to move the entire amount.

- Quick data entry with function keys: [F2] Pick all Items, [F3] Move to Recoverable, and finally [F1] to accept the values and post the transaction.

How to Enter Judgement [2-1-2-T]

While you can enter judgment from within the Paperless File, there is a financial transaction [2-1-2-T] called Enter Judgment:

This feature was added to make it easy to move pending costs and update judgment information by the same operator.

Why is moving pending costs a financial transaction?

On the surface, you would think that moving pending costs is a “cosmetic transaction” that does not need to be part of the accounting. However, as it turns out, to properly track these transactions, they need to be reported in the various accounting files.

Within the accounting, moving pending costs looks like a reversal of the original transaction and a posting of a new version. The original transaction shows the entry as “non-recoverable” expended, which is reversed, and then the new transaction shows it as recoverable.

Within the claim, the account card is updated to reflect the new status.

Ultimately, the complexity of the transaction and the required file locking require it to be a financial transaction.